What Is a Pitch Deck? Simple Guide for Winning Presentations

The Essential Tool for Startup Fundraising

Pitch decks are vital tools for entrepreneurs seeking investment, yet many underestimate their significance. A carefully crafted pitch deck can effectively convey your vision, address market needs, and ignite interest from potential investors - laying the foundation for your startup’s future success.

Understanding how to structure and send your pitch deck to investors effectively is crucial for making that vital first impression.

Understanding Pitch Deck Basics

A pitch deck is a concise presentation entrepreneurs use to communicate their business idea to potential investors. Think of it as your business’s highlight reel—a visual narrative showcasing your vision, problem-solving approach, and growth potential, typically in 10-15 slides. Whether seeking seed funding or approaching venture capitalists, a well-crafted pitch deck is your key to securing meetings and investment.

The Anatomy of an Effective Pitch Deck

Effective pitch decks follow a time-tested structure. According to Aram from The VC Factory, “VC pitch decks haven’t changed significantly for decades,” because investors need specific information in a logical sequence for quick assessment.

A standard pitch deck includes:

- Problem: Clearly define the market pain point.

- Solution: Present your product/service as the answer.

- Market Opportunity: Define your target audience and market size (TAM/SAM).

- Business Model: Explain revenue generation.

- Traction: Demonstrate progress with data (users, revenue, partnerships).

- Team: Showcase relevant expertise.

- Funding Ask: Specify capital needed and allocation.

Each slide should flow naturally, telling a compelling story about why your startup deserves investment.

What Sets Winning Pitch Decks Apart

Winning pitch decks balance information with inspiration. They convey founder passion, market insight, and competitive advantage through a compelling narrative.

Key qualities include:

- Visual Cohesion: Consistent branding and clean design.

- Clarity: Avoid jargon and complexity.

- Data Visualization: Use charts/graphs effectively.

- Proactive: Anticipate and address investor concerns.

- Clear CTA: Conclude with a specific next step.

Most importantly, tailor your deck. A deck for angels might emphasize vision, while one for VCs might focus more on scalability and ROI. Your pitch deck is often your first impression—make it professional, persuasive, and powerful.

Key Components of a Pitch Deck

Creating a pitch deck that captures investor attention requires including specific elements addressing their primary concerns. Each component builds your case for investment.

The Foundation: Problem and Solution

Start by articulating the specific problem your target market faces. Make it relatable, quantifiable, and resonant. As Naomi Haag at The Digideck notes, “The more specific you are about their pain points, the better.”

Then, present your solution clearly, explaining how it addresses these points. Use visuals like screenshots or diagrams. Highlight your unique value proposition—what makes your approach different?

Market Validation: Traction and Opportunity

Investors need to see a sizable market with growth potential. Include:

- Total Addressable Market (TAM) size.

- Serviceable Available Market (SAM) figures.

- Market growth trends.

- Competitive landscape.

Traction slides provide proof. Include metrics like:

- User/customer growth rates.

- Revenue figures or projections.

- Key partnerships or pilots.

- Customer testimonials.

Focus on demonstrating upward momentum to validate your model and suggest future growth.

Business Fundamentals: Model and Financials

Clearly explain how you make money (subscription, freemium, transaction-based, etc.). Include unit economics like Customer Acquisition Cost (CAC) vs. Lifetime Value (LTV).

Financial projections (3-5 years) should cover:

- Revenue forecasts.

- Expense projections.

- Burn rate and runway.

- Path to profitability.

- Key underlying assumptions.

The Human Element: Team and Investment Ask

Highlight your founding team’s expertise and relevant experience. Investors, especially early-stage, weigh team quality heavily. Include founders, key members, advisors, and any past successes.

Finally, be specific about your investment ask:

- Amount of funding sought.

- How funds will be allocated (product, marketing, hiring).

- Timeline for deployment.

- Milestones this funding enables.

Close with a strong call to action, inviting investors to the next step. Each component should be concise (ideally one slide) yet comprehensive, telling a cohesive story.

Steps to Create a Pitch Deck

Developing a winning pitch deck involves strategic thinking, clear communication, and visual design. Follow these steps:

Research and Planning Before designing, research target investors (portfolio, thesis, check size). Study successful decks in your industry. Gather necessary data: market stats, financials, testimonials, metrics. Organize this information first.

Crafting Your Narrative Outline your story: Problem -> Solution -> Uniqueness -> Go-to-Market/Revenue -> Traction -> Team -> Ask. Focus on ROI, growth, and market size, as advised by startup advisor Victor Barros. Write concise, impactful content for each slide. Prioritize clarity - the deck is an introduction, not an exhaustive plan.

Design and Visual Elements Use a clean, professional template aligned with your brand. Maintain consistent fonts (min. 18pt body), colors (2-3 primary + neutrals), and styling. Visualize data with charts/graphs. Use high-quality, relevant images and screenshots. Prioritize readability and whitespace.

Review, Refine, and Test Review for clarity, brevity, and logical flow. Test your deck with people matching your target audience (entrepreneurs, experts, non-prospect investors) for feedback. Refine confusing areas. Prepare different versions (send-ahead, presentation, appendix). Remember, it’s an iterative process.

By following these steps, you’ll create a professional deck showcasing your startup’s potential and increasing funding chances.

Design Tips for an Impactful Deck

Visual design significantly impacts investor perception. Good design enhances comprehension, maintains attention, and signals professionalism.

Master Visual Hierarchy and Simplicity

Guide the viewer’s eye with clear hierarchy (size, color, position). Each slide needs a focal point.

Use whitespace generously. Avoid clutter—it signals cluttered thinking. Limit each slide to one main idea; split complex slides if needed.

Typography and Color Psychology

Choose ≤ 2 complementary fonts (sans-serif like Helvetica, Montserrat recommended). Use min. 24pt headings, 18pt body. Ensure consistency and contrast. Use bold sparingly.

Develop a simple color palette (1 primary, 1 secondary, neutrals) reflecting your brand. Apply consistently. Use primary color for key data/conclusions. Understand color psychology (e.g., blue=trust, green=growth).

Data Visualization and Image Selection

Transform data into visual stories with appropriate charts (line, bar, pie). Keep visualizations clean, minimal, and clearly titled.

Use high-quality, relevant images/screenshots. Custom illustrations can simplify complex ideas. Prioritize quality over quantity.

Consistent Branding and Slide Templates

Maintain consistency across slides (title position, page numbers, visual elements, content treatment). Create a polished look with a template.

Your cover slide is crucial: clean logo, concise tagline, compelling visual. Ensure design is adaptable for various viewing contexts (large screen, mobile).

Implementing these principles creates a deck that looks professional and effectively communicates your vision.

Real World Pitch Deck Examples

Studying successful decks provides valuable lessons. Let’s examine notable examples.

Airbnb: Simplicity and Clear Problem-Solution

Airbnb’s 2008 seed deck ($600k raised) is famed for its simplicity. It focused laser-like on Problem (costly hotels), Solution (connecting travelers/locals), and Business Model (fees).

Uber (UberCab): Market Opportunity and Differentiation

Uber’s 2008 seed deck ($200k raised) emphasized market size ($20B US) and clear differentiation from taxis/limos. It outlined a focused go-to-market strategy. Key takeaway: Articulate market size and competitive advantage clearly.

Buffer: Traction and Validation

Buffer’s deck ($500k raised) effectively showcased early traction (users, MRR, updates published). It featured growth charts and testimonials, letting results speak for themselves. Transparency on the business model built credibility. Key takeaway: Lead with your strongest validation metrics.

LinkedIn: Vision and Market Understanding

LinkedIn’s 2004 Series B deck ($10M raised) excelled at communicating vision and market understanding. It showed deep insight into user needs and outlined a thoughtful monetization path, balancing big vision with practical steps. Key takeaway: Demonstrate market understanding and a clear, evolving vision.

Lessons from Successful Pitch Decks

Common themes:

- Clarity: Making complex ideas accessible.

- Quantification: Specific market opportunity figures.

- Honesty: Realistic competition assessment, clear differentiation.

- Validation: Showcasing strongest proof points (traction, growth).

- Balance: Visionary thinking + practical execution.

Adapt successful elements to your unique situation, highlighting strengths relevant to your stage and industry.

Level Up Your Pitch Deck Sharing with Papersend

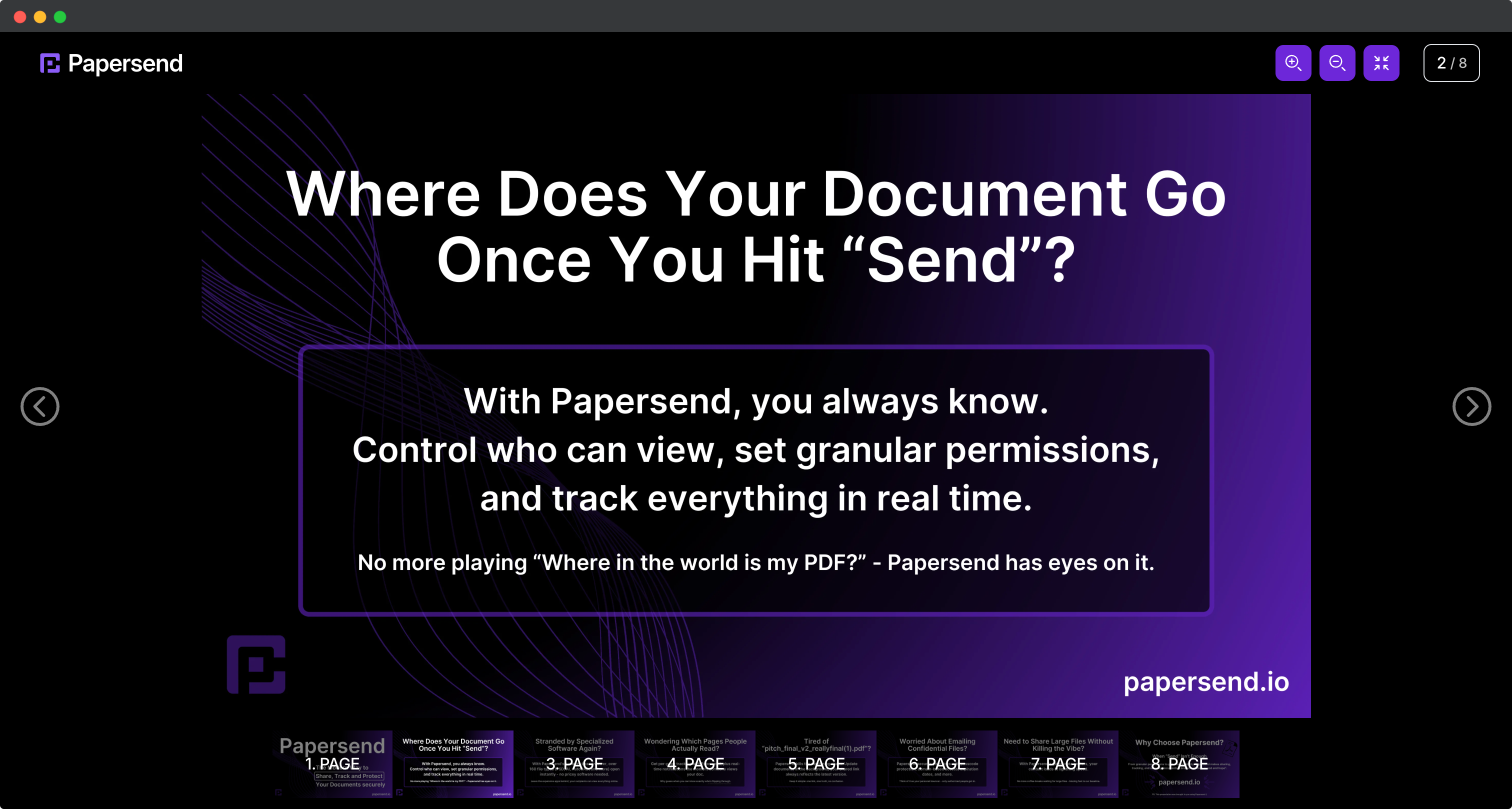

Your pitch deck is your crucial first impression. But creation is only half the battle. How do you share it securely and effectively? Managing access, ensuring confidentiality, and gaining engagement insights are paramount.

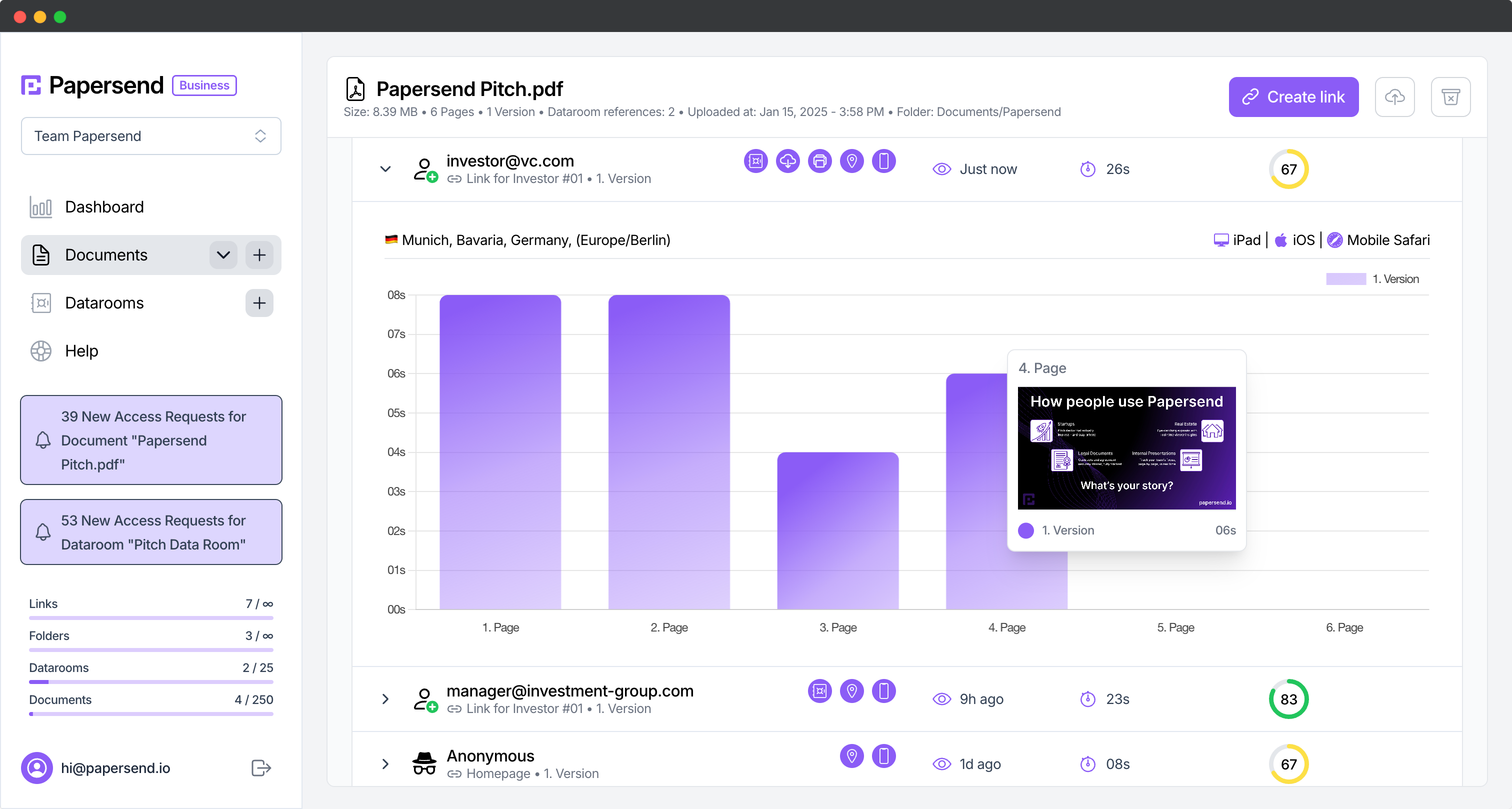

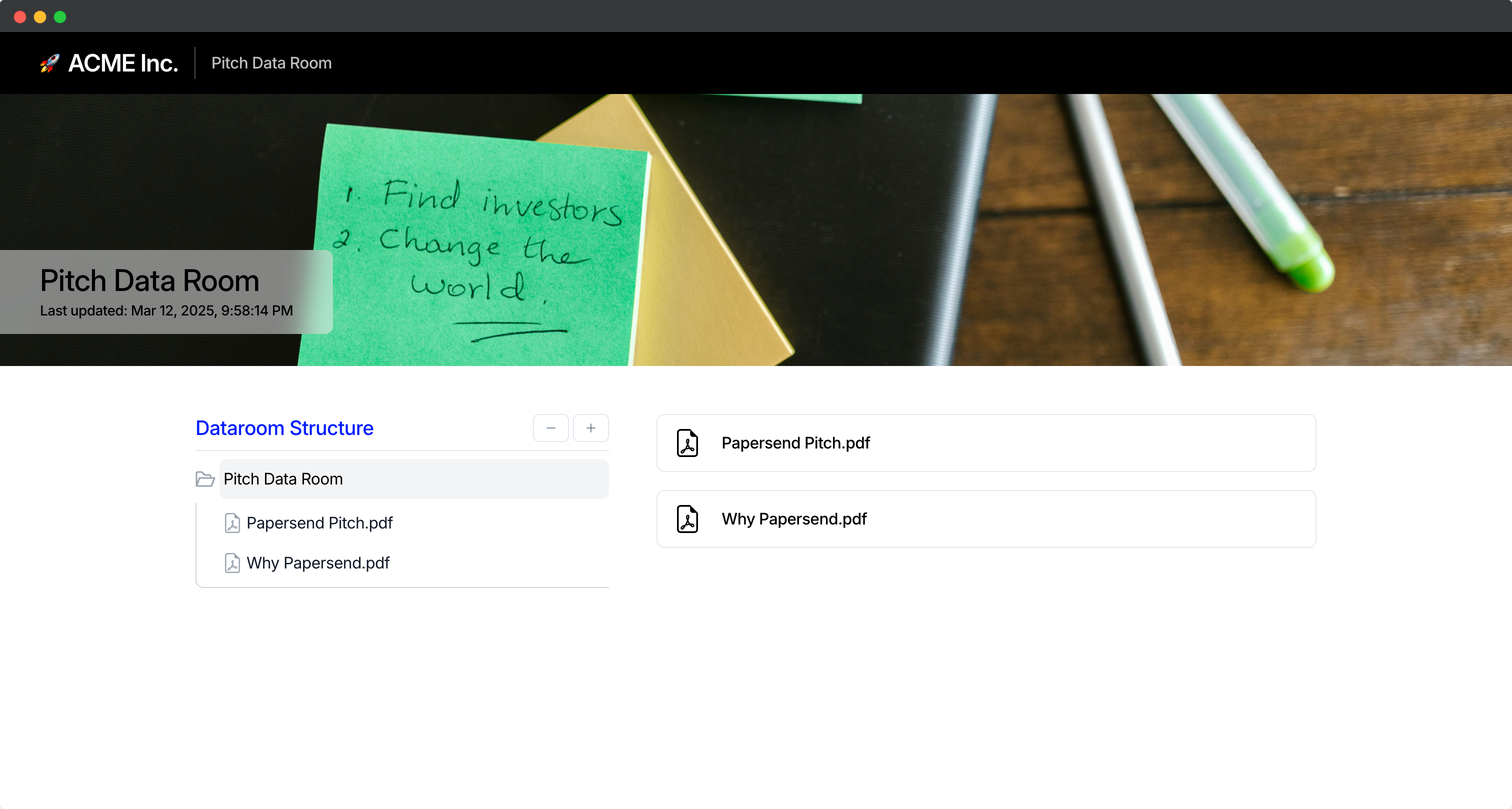

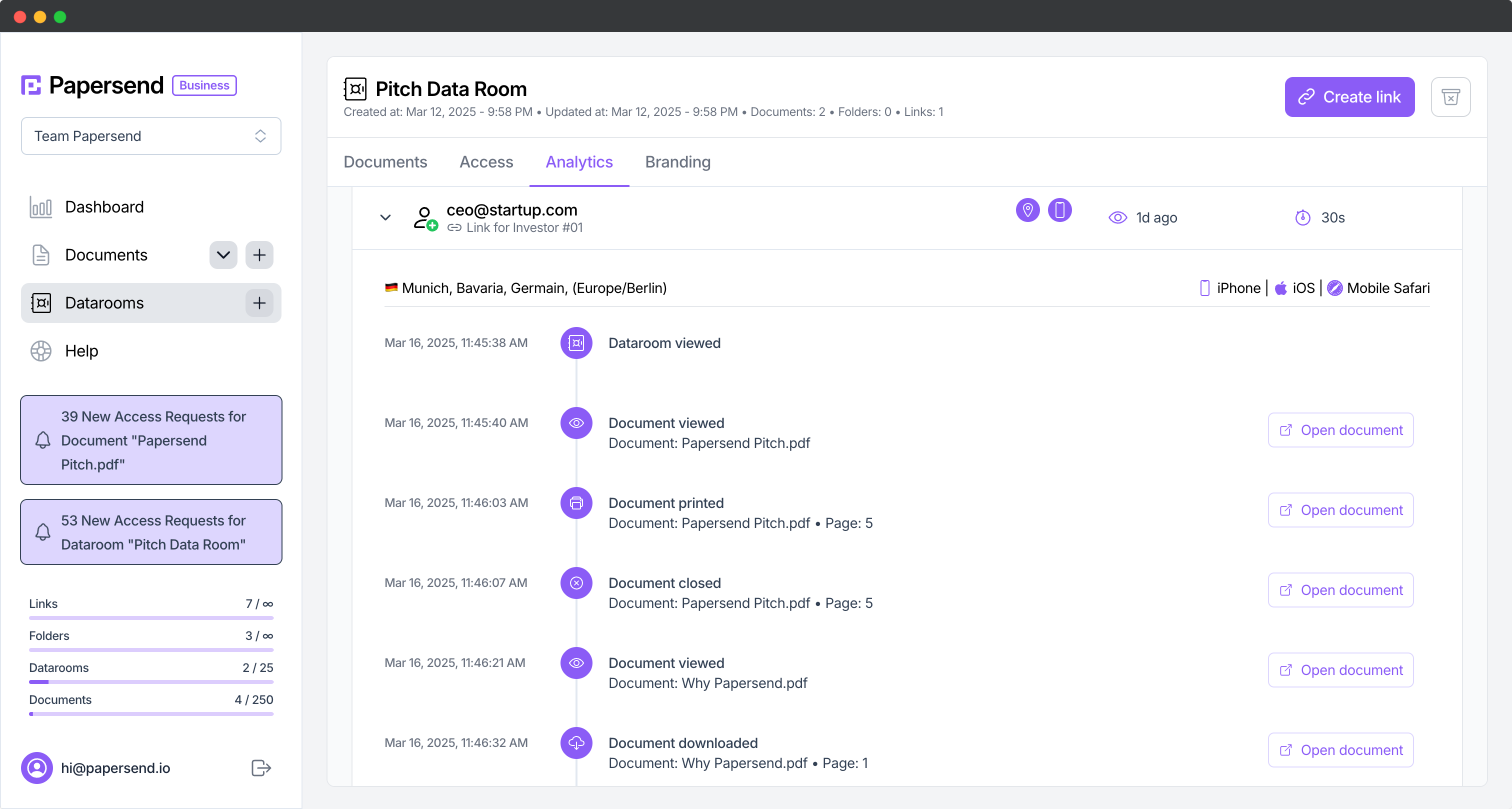

Papersend transforms how you share your pitch deck:

- Secure Document Sharing: Protect presentations from unauthorized access using robust security features. Share links with confidence.

- Document Tracking and Analytics: Gain invaluable insights. See who viewed your deck, when, for how long, and which slides captured attention with detailed document tracking.

- Custom Branding: Reinforce your startup’s identity with custom domains and branding on your shared documents and data rooms.

Take your pitch to the next level. Ensure your meticulously crafted deck reaches investors safely, makes a professional impact, and provides you with the analytics needed to follow up effectively.

Frequently Asked Questions

A pitch deck is a concise presentation, typically 10-15 slides, used by entrepreneurs to communicate their business idea, vision, market opportunity, and growth potential to potential investors.

Aim for 10-15 slides. Investors review decks quickly (often under 4 minutes), so clarity and impact are crucial. Focus on conveying key information efficiently.

Essential components include the problem statement, your solution, market opportunity analysis, business model, traction/metrics achieved, team introduction, and a specific funding request with fund allocation details.

Make your deck stand out with a clear narrative, strong visual design and branding, compelling data visualization, evidence of traction, and tailoring the content specifically for your target investor audience. Using tools like Papersend for secure sharing and tracking also adds professionalism.

Yes, include realistic 3-5 year financial projections covering revenue, expenses, burn rate, and key assumptions. Be prepared to explain and defend these numbers during your pitch.