How to Send a Pitch Deck to Investors in 2025

Why Your Pitch Deck Matters

Raising funds? A well-structured pitch deck is your golden ticket to securing investor interest. But how you share it is just as important as what’s in it.

Recommended Tools for Creating Pitch Decks

Creating a visually appealing and professional pitch deck is essential. Here are some great tools to help:

- Canva - A user-friendly design tool with customizable pitch deck templates.

- Pitch - A modern platform designed specifically for startups and teams to create investor-ready decks.

- Visme - A powerful design tool with drag-and-drop functionality and branding options.

- Prezi - Ideal for creating more interactive and engaging pitch presentations.

- Google Slides - A free and collaborative way to create pitch decks with team members.

Preparing Your Pitch Deck

Your pitch deck should tell a compelling story. Ensure it includes:

| Section | Description |

|---|---|

| 1. Introduction | Who you are and what your startup does. |

| 2. Problem Statement | The issue your product or service solves. |

| 3. Solution | How your company addresses the problem. |

| 4. Market Opportunity | Data to support demand for your solution. |

| 5. Business Model | Revenue generation strategy. |

| 6. Traction | Any growth metrics, sales, or partnerships. |

| 7. Marketing and Sales Strategy | Customer acquisition plan. |

| 8. Competition Analysis | Competitor landscape and your edge. |

| 9. Financial Projections | Revenue forecasts and funding needs. |

| 10. The Team | Key personnel and why they’re the right fit. |

| 11. Funding Requirements | How much you’re raising and how it will be used. |

| 12. Closing | Call to action for investors. |

Finding the Right Investors

Finding the right investors is crucial to securing funding. You want to target those who are not only willing to invest but also align with your industry and vision. Here are some effective ways to identify them:

- Investor Databases: Platforms like Crunchbase, AngelList, and PitchBook provide extensive lists of investors and firms.

- Industry Events & Pitch Competitions: Attend startup conferences, networking events, and pitch competitions to connect with potential investors.

- LinkedIn & X (formerly Twitter): Engage with investors on social media, comment on their posts, and build relationships before pitching.

- Startup Accelerators & Incubators: Many investors scout for startups through programs like Y Combinator, Techstars, and 500 Startups.

- Investor Matchmaking Services: Platforms like Gust and Fundable help startups find investors based on their funding stage and industry.

Choosing the Best Way to Share Your Pitch Deck

You have two primary options:

Option 1: Email Attachments ❌

- Lack security

- No analytics on investor engagement

- Risk of forwarding without consent

Option 2: Secure Document Links (Recommended) ✅

- Set view permissions (read-only, restricted access)

- Disable downloads to protect confidentiality

- Track investor engagement with view analytics

Securely Sharing Your Pitch Deck

Here’s how to upload and share your pitch deck securely:

- Upload Your Pitch Deck

- Log in to Papersend.

- Upload your PDF or PowerPoint presentation. Did you know? Papersend supports over 160 different file types.

- Set Access Controls

- Choose view-only mode to prevent downloads.

- Set an expiration date for link access.

- Generate a Secure Link

- Create a trackable link for each investor.

- Enable notifications for views & engagements.

Sending Your Pitch Deck to Investors

Your outreach email should be short, compelling, and personal:

Tracking Investor Engagement

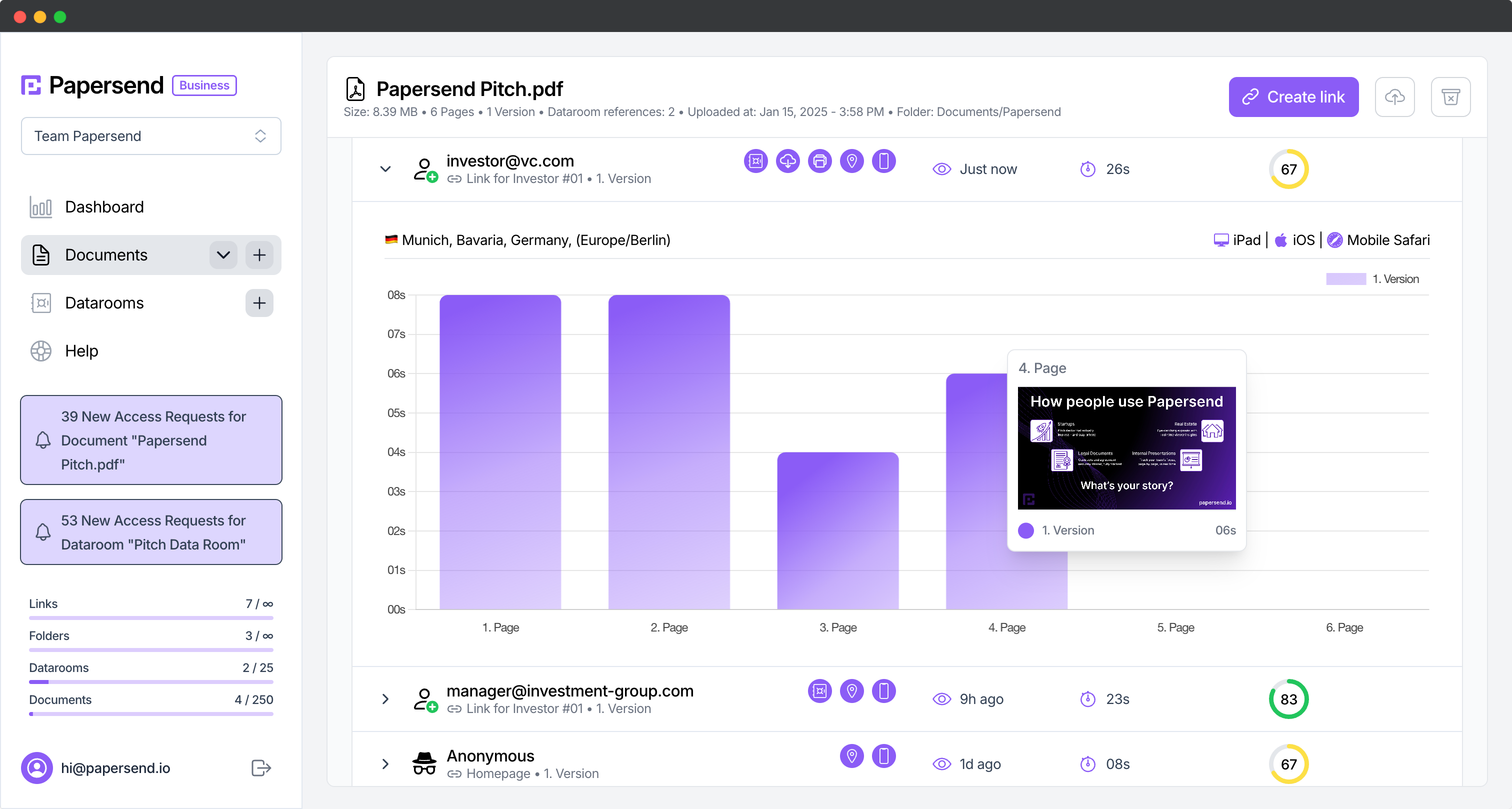

Papersend allows you to:

- See who viewed your deck and for how long.

- Identify which slides investors spent the most time on.

- Get real-time notifications when an investor opens your link.

Following Up Effectively

Follow-ups should be timely and strategic:

- 1-2 Days After First View: Send a friendly check-in.

- After Multiple Views: Request a meeting.

- No Response? Offer additional insights or a case study.

Setting Up a Data Room for Due Diligence

Once an investor shows interest, they may request more details. Create a data room with:

- Legal documents (NDAs, incorporation docs)

- Financial models & projections

- Customer testimonials & case studies

- Product demos & technical documentation

Conclusion

A well-prepared pitch deck won’t raise money on its own, but how you share it can make a huge difference. By using secure, trackable links, you protect sensitive data and gain valuable investor insights.

Ready to elevate your investor outreach?

Frequently Asked Questions

How you share your pitch deck is as crucial as its content. Secure sharing methods protect sensitive data, provide insights into investor engagement, and maintain control over your document, increasing the likelihood of securing investment.

Recommended tools include Canva for user-friendly design templates, Pitch for startup-focused presentations, Visme for powerful branding and drag-and-drop features, Prezi for interactive presentations, and Google Slides for collaborative team efforts.

A compelling pitch deck should include an introduction, problem statement, solution, market opportunity, business model, traction, marketing and sales strategy, competitive analysis, financial projections, team overview, funding requirements, and a clear call to action.

Use secure document links instead of email attachments to set view permissions, disable downloads, and track investor engagement. Platforms like Papersend allow you to monitor who viewed your deck, which slides they focused on, and send real-time notifications.

Follow up within 1-2 days after the first view with a friendly check-in. If investors view multiple times, request a meeting. If there's no response, offer additional insights or case studies. Once interest is shown, set up a data room with legal documents, financial models, and other relevant information.