Master Due Diligence with a Secure Virtual Data Room (VDR)

Streamlining High-Stakes Deals: Your Guide to Due Diligence VDRs

Navigating the complexities of due diligence, especially during high-stakes transactions like mergers and acquisitions (M&A), demands meticulous organization and unwavering security. Handling vast amounts of sensitive documents requires a robust solution. This is where a Due Diligence Virtual Data Room (VDR) becomes indispensable.

Forget cumbersome physical data rooms; the modern standard is a secure, efficient, online platform like Papersend, designed specifically for these critical processes. This guide explores what a VDR for due diligence is, why it’s vital, its core security features, how to approach setup, and its advantages over traditional methods. Understanding the power of a VDR is the first step towards streamlining your next deal.

What Exactly is a Virtual Data Room for Due Diligence?

At its core, a Virtual Data Room (VDR), sometimes simply called a data room, is a highly secure online repository designed for storing, managing, and sharing confidential documents and files. In the specific context of due diligence, a VDR serves as a centralized, controlled environment where sellers can provide potential buyers, investors, legal teams, and other authorized parties access to critical business information.

This typically includes financial records, contracts, intellectual property details, employee information, and more - everything needed for thorough examination during mergers and acquisitions, fundraising, audits, or other significant corporate events. Think of it as a fortified digital space built to facilitate transparency while maintaining strict control over sensitive due diligence data.

Why VDRs are Non-Negotiable in Modern Due Diligence Processes

Anyone who’s managed due diligence using older methods - chasing emails, managing complex spreadsheets of permissions, or overseeing a costly physical data room - understands the inherent risks and inefficiencies. The shift to VDRs isn’t just a trend; it’s a fundamental improvement driven by tangible benefits crucial for successful due diligence processes:

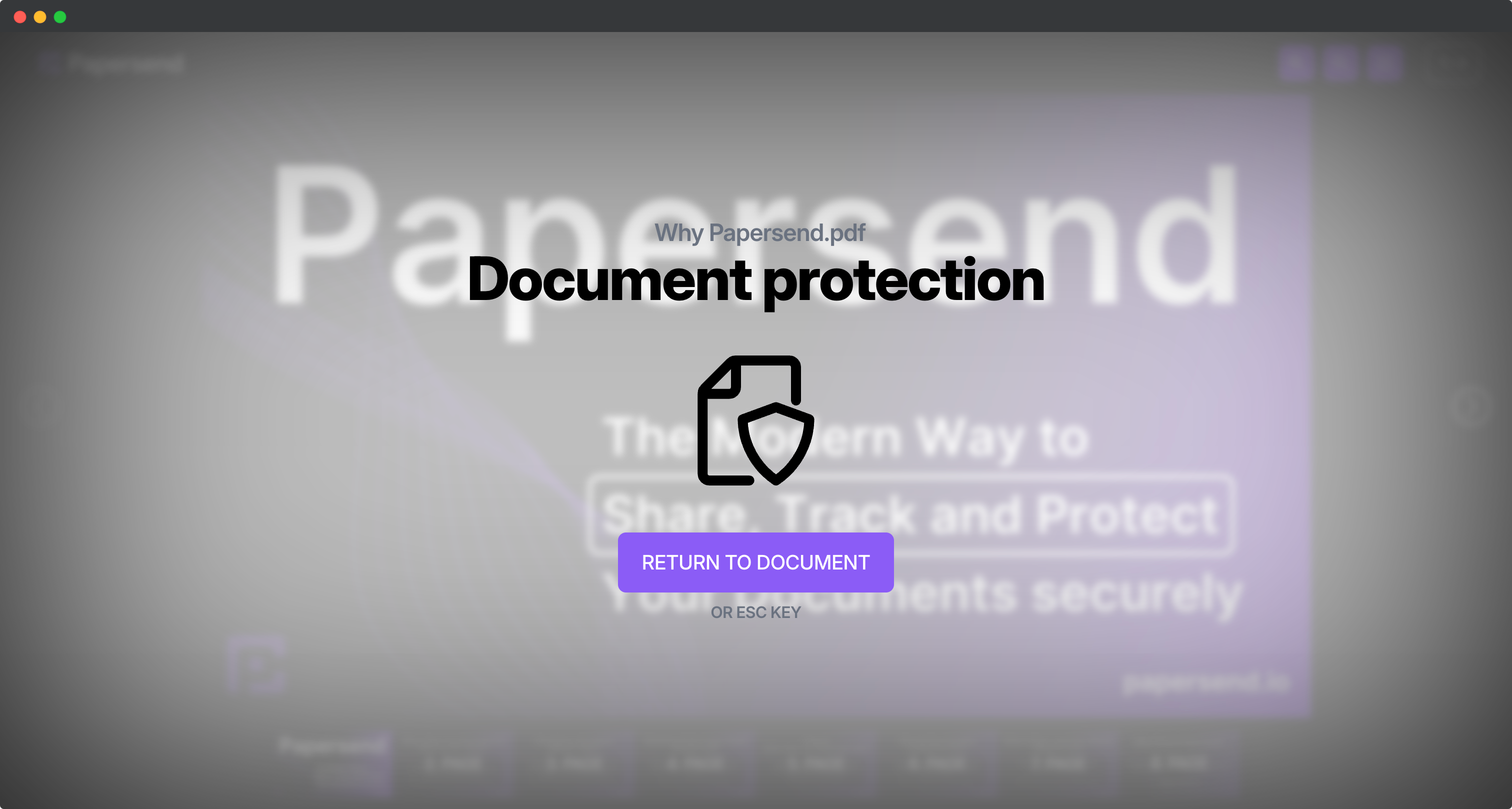

- Unparalleled Security: VDRs offer layers of protection far beyond standard file-sharing services. Features like encryption, access control, and watermarking ensure highly sensitive information remains confidential. Explore Papersend’s security commitment.

- Enhanced Efficiency: Time is critical in M&A. VDRs provide 24/7 remote access for authorized users globally, eliminating travel costs and delays. Features like advanced search, bulk uploads, and integrated Q&A modules drastically speed up the review process.

- Granular Control: Administrators maintain complete control over who sees what. Permissions can be set at the user, group, folder, or even individual document level, ensuring information is shared strictly on a need-to-know basis. All actions are tracked, providing a full audit trail.

- Cost-Effectiveness: While there’s an investment, VDRs eliminate the significant costs of physical data rooms (rent, security, travel, printing). The efficiency gains also translate to lower advisory fees and faster deal closure.

- Improved Collaboration: VDRs facilitate communication between parties through integrated Q&A features, keeping discussions organized and linked to specific documents within the secure environment.

Using a dedicated due diligence virtual data room signals preparedness and builds trust from the outset.

Unpacking the Security Features of a Due Diligence VDR

The cornerstone of any reputable VDR is its robust security infrastructure. When handling confidential due diligence data, trust is paramount. Here’s how a secure VDR like Papersend protects your information:

- Data Encryption: Files are encrypted both while stored (at rest) using AES-256 and during transfer (in transit) using TLS 1.2+, making them unreadable even if intercepted.

- Granular Access Permissions: This is crucial. Admins can precisely define user rights - view only, download (with/without print), upload - preventing unauthorized actions. Permissions can be adjusted or revoked instantly.

- Dynamic Watermarking: Documents viewed or downloaded can be automatically stamped with the user’s name, email, IP address, and time of access. This powerful feature deters unauthorized sharing and helps trace leaks if they occur.

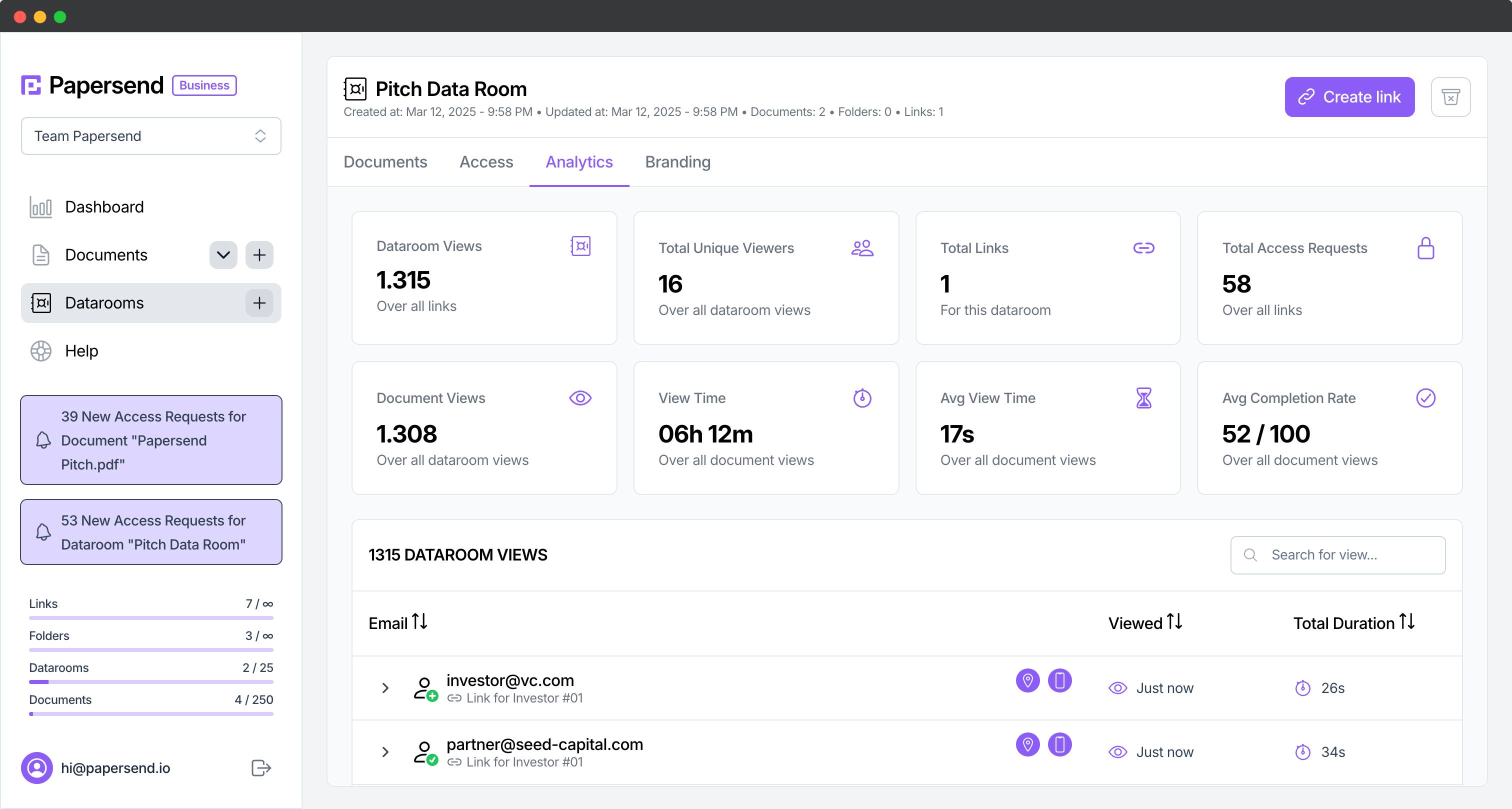

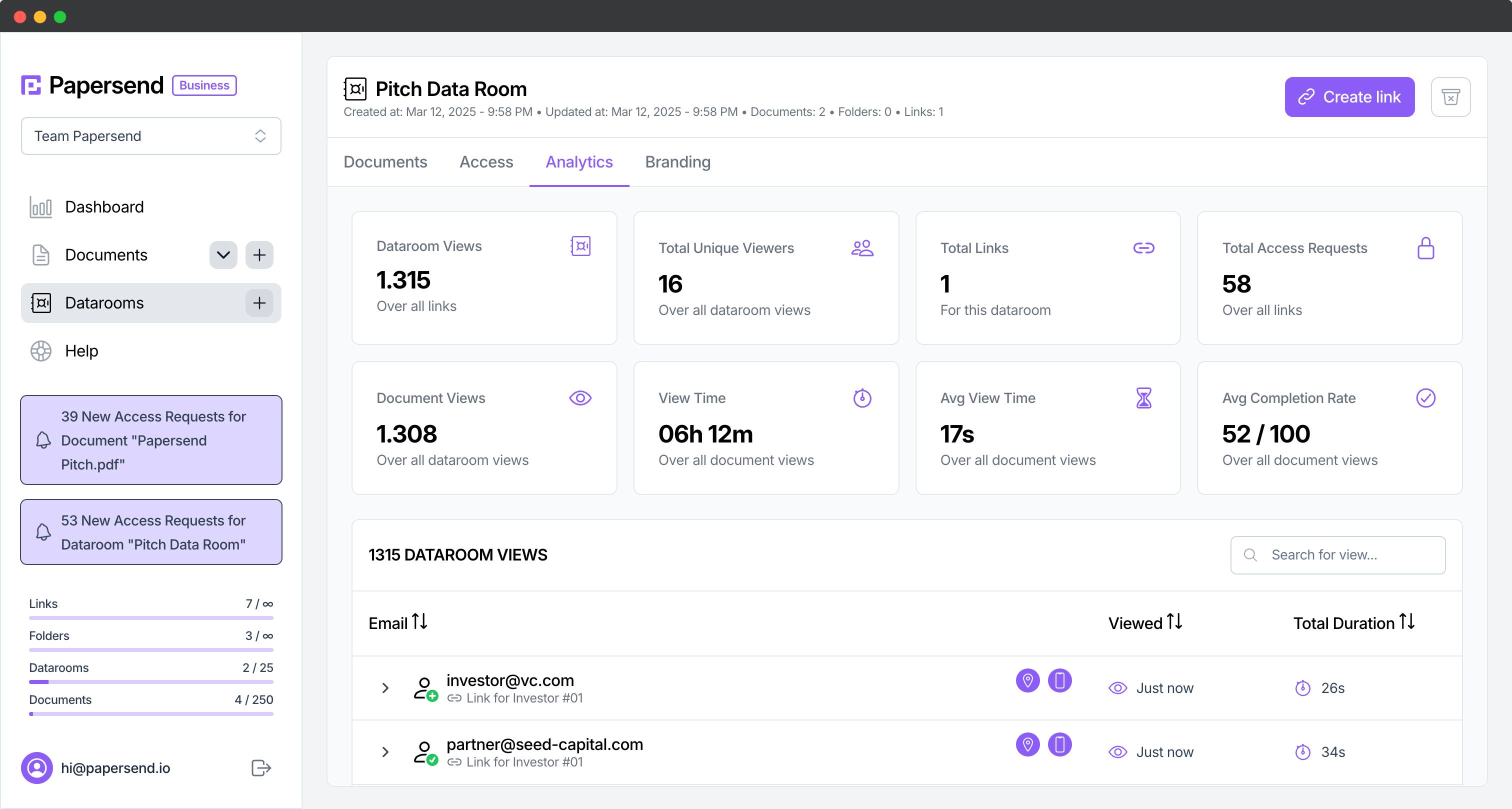

- Comprehensive Audit Trails: Every action taken within the VDR - logins, document views, downloads, searches, Q&A activity - is meticulously logged. This provides complete visibility and accountability, essential for compliance and post-deal analysis.

- Secure Authentication: Multi-factor authentication (MFA), complex password requirements, and automatic session timeouts add extra layers of protection against unauthorized access.

- Compliance & Certifications: Look for VDR providers compliant with international security standards like ISO 27001, SOC 2, and GDPR. Papersend is hosted in ISO 27001 certified data centers within the EU.

These features collectively create a secure place specifically designed for the rigors of due diligence.

Setting Up Your Due Diligence Data Room for Success

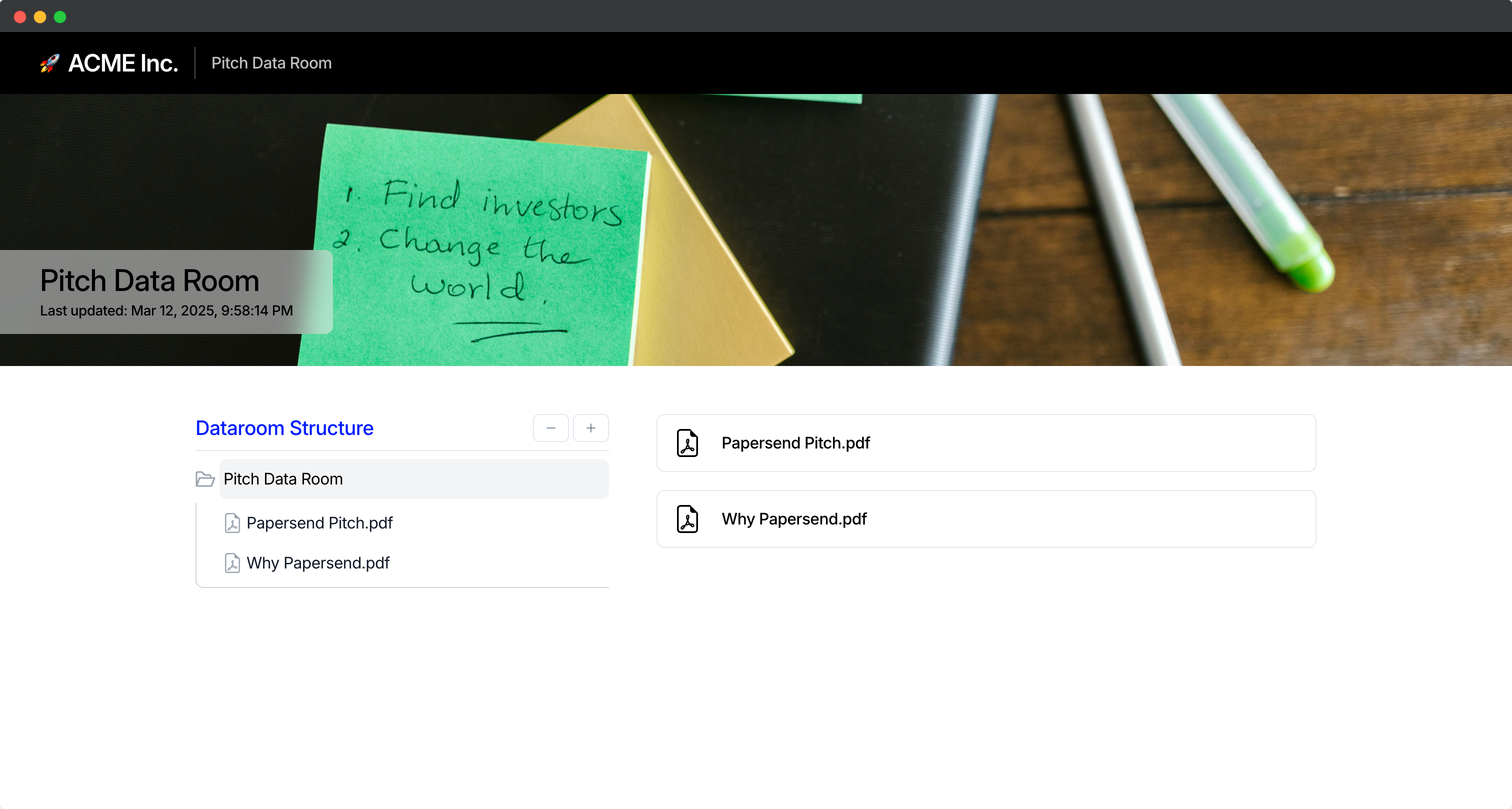

While VDR providers like Papersend offer intuitive interfaces and support, understanding the setup best practices helps ensure a smooth process. A well-organized data room significantly aids reviewers and streamlines the entire due diligence workflow.

Choose the Right VDR Provider Select a provider known for robust security, ease of use, essential features (like granular permissions, watermarking, Q&A, detailed analytics), and reliable customer support. Consider the specific needs and scale of your transaction. Check out this helpful virtual data room checklist.

Design the Folder Structure (Index) Before uploading, create a logical index (folder hierarchy). This often mirrors a standard due diligence checklist (e.g., Financial, Legal, Commercial, HR). Consistency and clear naming are key for intuitive navigation.

Prepare and Upload Documents Gather, vet, and organize your documents. Use bulk upload features to efficiently store documents and files. Ensure documents are clearly named and placed in the correct folders according to your index. Consider using a staging area if needed.

Invite Users and Define Groups Add users (potential buyers, advisors, internal teams) and organize them into groups based on their roles or the information they need access to (e.g., ‘Buyer Team A’, ‘Legal Advisors’, ‘Internal Finance’).

Configure Permissions Meticulously Carefully assign access rights for each group or individual user. Apply the principle of least privilege - grant only the minimum necessary access required for their role. Double-check permissions before granting access to the VDR.

Go Live and Monitor Activity Notify users when the VDR is active. Utilize the reporting and audit trail features to track engagement, monitor progress, identify bottlenecks, and answer questions promptly via the Q&A module if available.

A thoughtful approach when you set up a data room pays dividends in efficiency, user satisfaction, and overall deal momentum during the critical review period.

VDR vs. Physical Data Room: Understanding the Key Differences

The concept of a data room originated with secure physical locations housing hard-copy documents. While serving a similar fundamental purpose, the virtual data room (VDR) offers distinct, game-changing advantages for modern business:

| Feature | Physical Data Room | Due Diligence Virtual Data Room (VDR) |

|---|---|---|

| Accessibility | Restricted to physical location & hours | 24/7 secure remote access from anywhere |

| Security | Physical security (guards, logs) | Advanced digital security (encryption, permissions, audit trails, watermarking, MFA) |

| Cost | Very High (rent, travel, staffing, printing, security) | Lower overall cost, predictable subscription |

| Efficiency | Extremely Slow (manual review, travel time, copying) | Very Fast (digital search, instant access, no travel, bulk actions) |

| Document Mgt | Manual organization, risk of damage/loss, version control nightmare | Easy digital organization, version control, backups |

| Audit Trail | Limited & manual (sign-in sheets) | Comprehensive, automatic digital tracking of all actions |

| Collaboration | Difficult, often offline | Integrated Q&A, streamlined communication |

| Environment | High paper usage, resource-intensive | Eco-friendly, largely paperless |

While physical rooms had their place historically, the secure online repository offered by a VDR is unequivocally the superior standard for modern due diligence, providing unmatched security, efficiency, control, and cost-effectiveness.

Conclusion: Streamline Your Next Deal with a Due Diligence VDR

In today’s fast-paced, data-driven business environment, conducting thorough and efficient due diligence is paramount for successful transactions. A Due Diligence Virtual Data Room (VDR) is no longer a luxury but an essential tool for mergers and acquisitions, fundraising, audits, strategic partnerships, and any process requiring the secure exchange of sensitive information.

By providing robust multi-layered security, granular control over access, unparalleled accessibility, and significant efficiency gains over outdated methods, modern VDRs like Papersend empower organizations to manage critical data effectively and confidently. Choosing the right VDR platform ensures your confidential information is protected, due diligence processes are streamlined, and your transaction proceeds smoothly towards a successful closing.

Make your next due diligence process more secure, efficient, and professional by leveraging the power of a dedicated virtual data room.

Frequently Asked Questions

A virtual data room (VDR) is a secure online platform used during due diligence to store, manage, and share confidential documents and files related to business transactions like mergers and acquisitions. It provides a controlled environment for multiple parties to review critical information efficiently and securely. Discover more about Papersend's Virtual Data Rooms.

Virtual data rooms utilize features like end-to-end encryption, granular access permissions, dynamic watermarking, secure authentication (MFA), and comprehensive audit trails to protect sensitive documents. This ensures only authorized users can access specific information during the due diligence process. Learn about Papersend's robust security measures.

A physical data room was a secure physical location with hard copy documents, requiring travel and manual processes. A virtual data room (VDR) is a secure online repository accessible remotely 24/7, offering significantly enhanced digital security features, easier document management, built-in audit trails, and substantial cost savings compared to physical rooms.

VDRs are crucial for M&A because they provide a secure, centralized, and highly efficient way to manage the vast amount of sensitive documentation required for the due diligence process. They facilitate faster review by buyers, sellers, and advisors, improve collaboration, and maintain strict confidentiality, ultimately accelerating deal timelines. See how Papersend supports M&A transactions.

Absolutely. Virtual data rooms like Papersend are specifically designed to be set up for due diligence. You can easily create a logical folder structure, bulk upload relevant documents, define precise user permissions, and invite stakeholders to review the necessary files securely online, all tracked with detailed analytics.